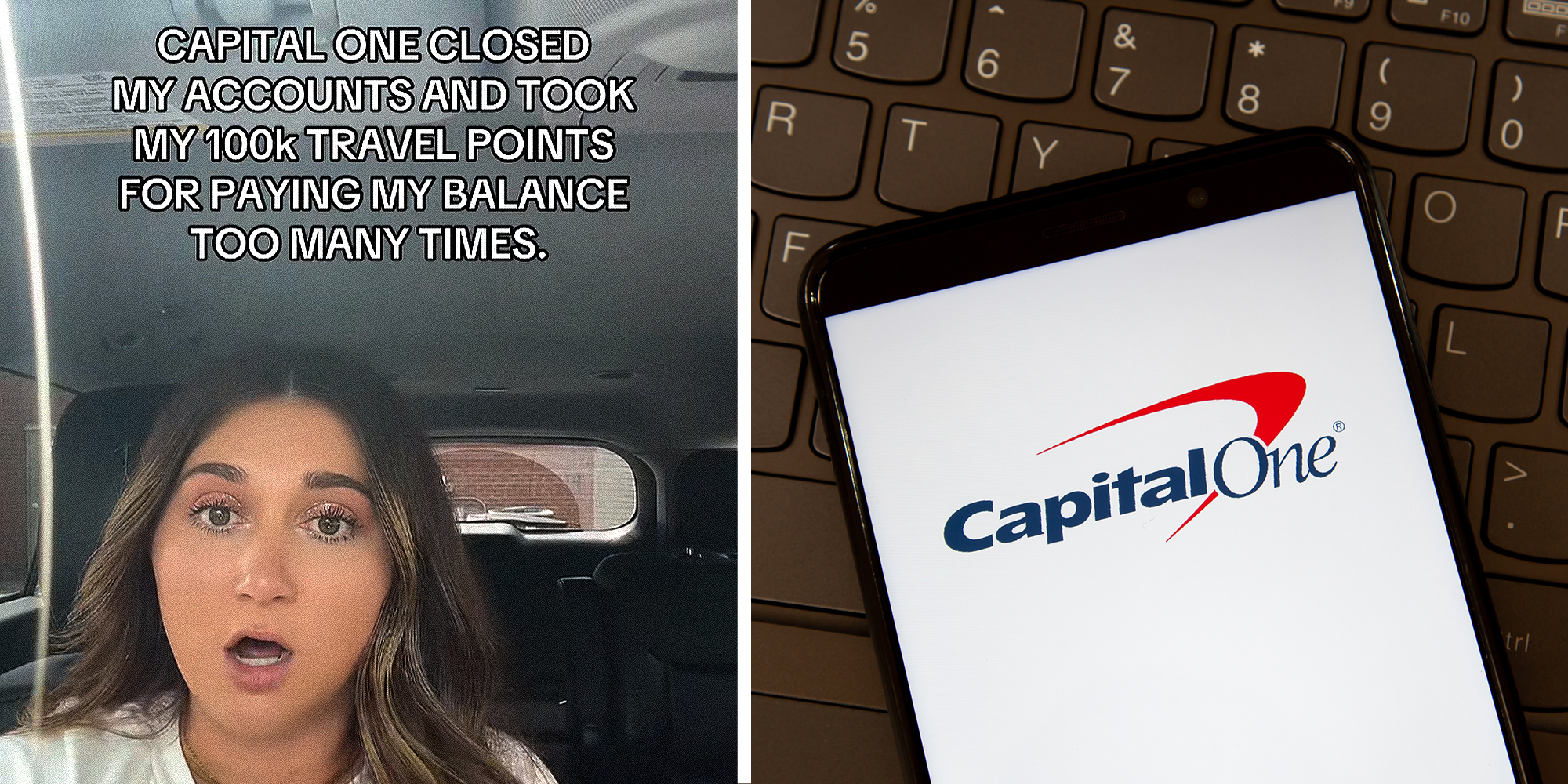

‘Capital One clearly wants their customers to be in debt’: Woman says Capital One closed her bank accounts and stole 100,000 travel rewards points. It’s because she paid her card off weekly

In order to build good credit, experts suggest keeping your utilization low, avoiding unnecessary new credit applications, and paying the full balance on time every month.

While this is good advice for keeping one’s credit in good standing, it also might help prevent one’s accounts from being closed. Numerous internet users have shared how their behavior inadvertently led to their accounts being closed or frozen, with many finding it difficult to both resolve the issue and get their money back.

Now, another internet user has alleged that Capital One closed her accounts without explanation, taking around 100,000 Rewards points in the process.

Why did Capital One close this woman’s account?

In a video with over 1.5 million views, TikTok user Tiffany Upton (@tiffanyjupton) says that Capital One closed her account for “paying [her] balance too many times.”

According to Upton, she had two cards with Capital One: a Venture card that she used for business expenses, and a personal card. She also had a savings account with the bank. Aside from that, she says she has a Square POS system for her business that has its own checking account provided by Sutton Bank, and a separate account at a bank called Pinnacle Bank.

For Capital One specifically, Upton says that "every single week, I order a certain amount of products” for her business, and that she uses her “Capital One Venture card to collect points on that.”

“So, every single week I would order a certain amount of products, and I would pay it off weekly so that I could reuse it again,” she explains. By doing this, she says she was able to accumulate around 100,000 Capital One Rewards points.

While this apparently did not cause issues for the several years her business has been running, she says that she recently did one of her normal weekly pay-offs. But the action led Capital One to close her account due to “suspicious activity.”

Verifying identity

Upton says she later received a call from Capital One asking her to verify purchases, which she did. She was then told that they would need to confer with her local bank to confirm her identity.

“I was thinking it was kind of ridiculous because I'm making payments to you and I'm paying my credit card off, but OK, fine, like, let's confirm that I own these accounts,” she says.

First, they confirmed her identity with Pinnacle Bank. Then, they attempted to confirm her identity through Sutton Bank, which did not immediately work. Despite Upton providing numerous other methods of verification from the bank, she says Capital One could not confirm her identity.

As a result, Capital One closed her accounts, causing her to lose her 100,000 in Capital One Rewards points.

“I can no longer have a credit card with Capital One because I paid them too much money,” she summarizes.

“The craziest thing that has ever happened,” she wrote in the caption. “You try to be smart with your money, but capital one clearly wants their customers to stay in debt. Do not bank with them bc they will screw you over.”

What happened next?

In a follow-up video, Upton does not provide any update. However, she notes that it is curious that Capital One still accepted her payment from her Square checking account. That's the one Capital One allegedly said that it could not verify.

Instead, Upton reiterates that she believes that she provided Capital One with all the documentation they requested. Additionally, she says that when she questioned Capital One’s fraud department about why this happened, she was told that it could have something to do with the fact that she was paying off her card weekly as opposed to monthly, a practice she says was in part because “the limit on that card isn’t that high.”

In response to this statement, the fraud department worker questioned whether she had applied for a credit limit increase, to which she said she hadn’t.

Finally, Upton alleges that she reached out to Square, which claimed it had no record of Capital One reaching out to try to verify her identity.

“I don't know at this point if I don't think they will reinstate my accounts because they have already closed them and taken all my points away, so I don't know that it's even worth fighting at this point,” she says.

What caused her accounts to be closed?

It’s unclear why Capital One decided to close her accounts. However, some commenters offered a few theories.

First, many commenters mentioned the concept of “credit cycling.” This is where one repeatedly charges the card to its limit and then pays it off, effectively allowing them to use more credit than their limit.

While this is not illegal, it may be against some terms of service, and, at the very least, it can mark an account’s behavior as suspicious.

Second, the reason could simply be Capital One’s inability to adequately verify Upton’s information. Whether this is the bank’s fault or her own is debatable, but Capital One could be being honest about the alleged reasons for closing her account.

Finally, it could simply be an error on the part of the fraud detection team.

Unfortunately for Upton, internet users say that they’ve had little success getting Capital One to reopen their accounts after closure.

@tiffanyjupton The craziest thing that has ever happened. You try to be smart with your money, but capital one clearly wants their customers to stay in debt. Do not bank with them bc they will screw you over.

♬ original sound - tiffanyjupton

'Credit limit increase.'

In the comments section, users offered their thoughts about what could have happened as well as potential resolutions for the issue.

“Didn’t pay them any interest that’s what pisses them off. It’s ridiculous,” wrote a user. “I’m very sad that they did this to you.”

“Try contacting the bbb it’s never failed me,” suggested another.

“She was beating around the bush trying to tell u that u were credit cycling without actually saying it and also gave you a way to remedy the problem… credit limit increase,” speculated a third.

The Daily Dot reached out to Capital One via email and Upton via TikTok DM and comment.

Internet culture is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s web_crawlr newsletter here. You’ll get the best (and worst) of the internet straight into your inbox.

Sign up to receive the Daily Dot’s Internet Insider newsletter for urgent news from the frontline of online.

The post ‘Capital One clearly wants their customers to be in debt’: Woman says Capital One closed her bank accounts and stole 100,000 travel rewards points. It’s because she paid her card off weekly appeared first on The Daily Dot.

dailynoti coindeskcrypto cryptonewscrypto bitcoinmymagazine mybitcoinist cryptowithpotato mycryptoslate fivenewscrypto findtechcrunch journalpayments nulltxcrypto newsbtcarea

Post a Comment