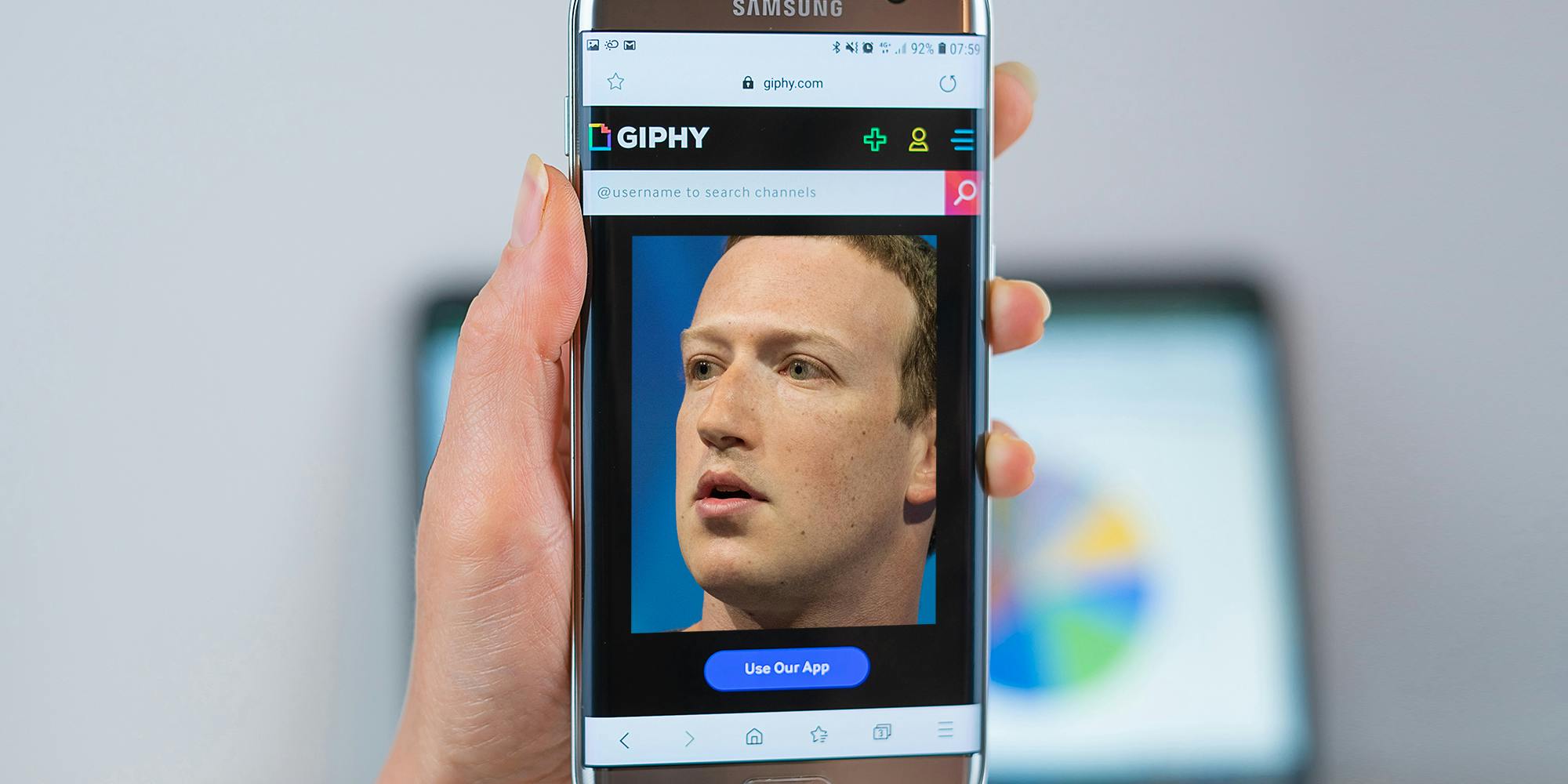

Meta forced to sell Giphy

A competition watchdog in the U.K. ordered Meta, the parent company of Facebook, to sell the popular animated GIF website Giphy.

Acquired by Meta two years ago for $400 million, Giphy supplies animated GIFs to some of the largest social media platforms including Snapchat, TikTok, and Twitter.

But in November of last year, the Competition and Markets Authority (CMA), fearing that Meta could cut off its competitors' access to Giphy or demand increased user data, ordered Meta to sell the company.

Meta responded at the time by appealing the decision, although it was ultimately upheld by the Competition Appeal Tribunal in July. After the ruling, the CMA carried out a review of its decision and allowed Meta once again to submit any objections.

Today, however, the CMA announced that its initial ruling that Meta must sell Giphy would stand.

Regulators argue that the decision will keep Meta from further dominating the social media market in the U.K. As noted by the Guardian, Meta's products, including Facebook and Instagram, already account for "73% of user time spent on social media in the U.K."

Meta on Tuesday announced that it would accept the ruling "as the final word on the matter."

A Meta spokesperson stated that the company would work closely with the CMA to divest from Giphy.

“We are grateful to the Giphy team during this uncertain time for their business, and wish them every success," the spokesperson said. "We will continue to evaluate opportunities—including through acquisition—to bring innovation and choice to more people in the UK and around the world.”

Sign up to receive the Daily Dot’s Internet Insider newsletter for urgent news from the frontline of online.

The post Meta forced to sell Giphy appeared first on The Daily Dot.

dailynoti coindeskcrypto cryptonewscrypto bitcoinmymagazine mybitcoinist cryptowithpotato mycryptoslate fivenewscrypto findtechcrunch journalpayments nulltxcrypto newsbtcarea

Post a Comment